“If you wanna be with me

Baby, there's a price you pay

I'm a genie in a bottle

You gotta rub me the right way

If you wanna be with me

I can make your wish come true

Just come and set me free, baby

And i'll be with you”

Christina Aguilera

We've received many insightful comments and questions, and we plan to address them in the coming weeks and months. Some require deeper consideration before we can provide our perspective. However, a recent request for a pop music intro coincided neatly with last Wednesday's CPI report. Christina Aguilera's hit "Genie In a Bottle" seemed fitting. After years of attempting to generate inflation with 0% rates and QE, it seems the inflation genie has been unleashed, and Fed Chair Powell is left fumbling around like a teenage boy. Alternatively, Dua Lipa's "Training Season" was our second choice, signaling that if inflation remains unruly, then training season is over and all market bets are off.

We recently revisited Ben Bernanke's 2002 speech, "Deflation: Making Sure 'It' Doesn’t Happen Here," which detailed the Federal Reserve's strategies to counter deflation. Implicit in this speech was the idea that preventing deflation effectively involves maintaining a healthy level of inflation, later formalized as a 2% target. This goal has underpinned much of the Fed's policy for the past twenty years, aimed at sustaining inflation to avoid a deflationary spiral like that experienced in Japan.

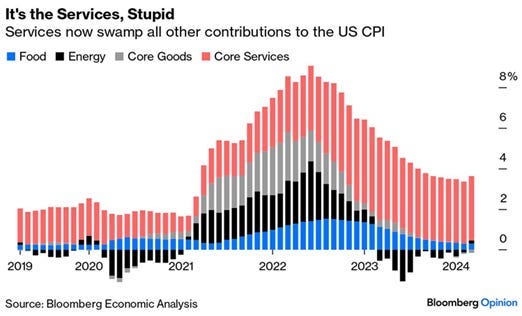

Despite various policy experiments that many thought would ignite inflation over the last two decades, inflation remained stable. It wasn’t until the supply chain disruptions of 2020, triggered by the COVID pandemic, and the subsequent fiscal and monetary responses reignited inflationary pressures not seen since the Volcker era. Today, inflation remains above the Fed’s target and improvement in the trend has seemingly stalled as last week’s CPI report showed.

Despite a discouraging report, our outlook remains optimistic, though we are cautiously assessing whether this optimism might be misplaced. Persistent core services inflation, particularly within housing services which account for over half of the core services measure, has shown remarkable resilience. Core services ex housing also has exhibited a “stickiness”—a term frequently echoed in the media. Housing inflation is primarily gauged through Owners' Equivalent Rent (OER), a theoretical measure that estimates the rental value homeowners would pay for their own homes. This measure, derived from rental market prices, significantly impacts the Core CPI due to its substantial weight, reflecting the major role housing costs play in consumer budgets.

The weight of OER in the Consumer Price Index (CPI) and its counterpart in the Personal Consumption Expenditures (PCE) Price Index differ significantly, reflecting the different methodologies and purposes of these two inflation measures. As mentioned, in the Core CPI, which excludes food and energy, the OER carries a substantial weight, around 30% or more. This is due to the CPI's focus on out-of-pocket expenses for consumers.

In contrast, the PCE Price Index, which measures the prices paid for goods and services by U.S. residents, has a broader scope, including expenditures by businesses, government, and nonprofit organizations serving households. The weight assigned to housing costs, specifically the imputed rental value for homeowners (analogous to OER in the CPI), is generally lower in the PCE than in the CPI. Typically, this value is less than 20% of the overall index, often around 15%.

The Federal Reserve has indicated a preference for the PCE as its primary inflation measure, which informs our emphasis on this index when attempting to anticipate future policy directions. As of February 2024, the Core PCE Price Index has risen by 2.8% from the previous year, a slight decline from January's year-over-year increase of 2.9%. For comparison, the most recent Core CPI report showed an annualized increase of 3.8%. The forthcoming data release of PCE on April 26, 2024 will be widely anticipated by market participants.

Regardless, both measures of inflation are lagging indicators meaning they reflect changes in economic conditions or trends after they have already occurred. This is helpful for policymakers to confirm trends in economic activity, but is not helpful in guiding policymakers in the future direction of the economy. In our view, too much emphasis has been placed on these lagging indicators and we see a more moderate level of PCE inflation as more constructive for determining future policy actions. Furthermore, leading and coincident indicators of economic health are showing signs of strains from the impact of higher rates which will likely attract more focus.

In summary, the inflation picture remains stubbornly high, but the Federal Reserve continues to maintain that the rate-hiking cycle has ended, and the next adjustment will likely be a rate cut. The timing and magnitude of these potential cuts are currently under debate. Regardless of whether rate cuts occur this year, the expectation of future policy will continue to have a significant impact on the markets and asset prices, which is a major concern for us. We believe if the Fed does cut this year, policy will continue to be restrictive and a moderate scaling back of the Fed's balance sheet should also moderate economic activity.

The release of the inflation genie poses significant challenges for the Fed, necessitating adept management to prevent it from dominating the economic narrative. Amid these uncertainties as well as many other complexities facing investors, we maintain a well-hedged and diversified portfolio to navigate any adverse conditions as we await more definitive economic signals. We believe this approach is prudent for the current climate.

Thank you for reading Wondering Aloud.

Steve Barth, CFA

Wondering Macro LLC

Wondered where this was going from the quote :)